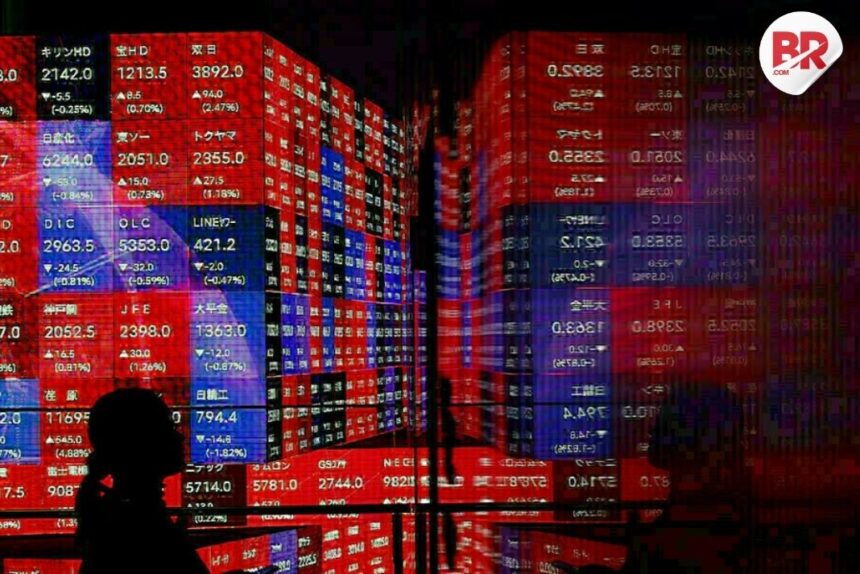

Asian markets opened Tuesday on a nervous note. The trigger? Donald Trump’s latest warning on tariffs. While some indexes stayed calm, others showed clear signs of stress. Investors are watching closely, and the fear of a trade war is creeping back.

Mixed Start for Asian Markets

In Japan, the Nikkei 225 rose slightly—just 0.1%—to 39,507.28. Australia’s ASX 200 did better, adding 0.4%. But not everyone stayed in the green. South Korea’s Kospi fell 0.2%, and Hong Kong’s Hang Seng dropped 0.1%. The worst hit was Shanghai, which dipped almost 0.9% after China’s growth numbers showed a slowdown.

China Growth Slows as Tariff Pressure Builds

China’s economy still grew by 5.2% this past quarter. But that’s a slowdown from the 5.4% growth seen earlier this year. On a quarterly basis, it grew just 1.1%. Investors worry this is a sign that the trade war is hurting Asia’s biggest economy.

With Trump’s new tariff threats set to start on August 1, many fear it could hit exporters hard. But there’s also hope. Talks may continue, and some analysts believe Trump is bluffing to gain leverage.

Wall Street Shrugs, For Now

Back in the U.S., markets were calm on Monday. The S&P 500 rose 0.1%, the Dow added 0.2%, and the Nasdaq gained 0.3%. That calm hasn’t yet reached Asia, where election jitters in Japan are also making investors cautious. The ruling Liberal Democratic Party could face a tough fight in Sunday’s vote.

Also Read Trump Wants 1% Fed Rate – Experts Say It Could Backfire on US Economy

What’s Next for the Markets?

Experts believe Trump may back off if markets start to shake. “This might just be pressure tactics,” said a UBS analyst. Others agree. “Markets don’t like the noise,” said Brian Jacobsen from Annex Wealth, “but they’re not in panic mode yet.”

Meanwhile, U.S. inflation data is due Tuesday. Economists expect a rise to 2.6%, up from 2.4% in May. That could shake global sentiment further.

Company Moves and Crypto Buzz

In corporate news, Fastenal surprised with strong profits. Its stock jumped 2.9%, even as it warned of weak market conditions. Kenvue, a former part of Johnson & Johnson, also rose after its CEO stepped down during a strategy review.

And yes, bitcoin is still booming. With Crypto Week happening in Washington, all eyes are on whether the U.S. wants to become the global crypto king.

In Other Markets…

- U.S. crude fell to $66.67 a barrel

- Brent crude dropped to $68.96

- The U.S. dollar dipped to 147.59 yen

- The euro rose to $1.1676

Also Read India-US Trade Deal: Talks Begin in Washington as Trump’s Tariff Deadline Approaches