The Maldives is famous for its beautiful beaches and attracts tourists from around the world. However, behind this paradise, the country is facing a serious financial crisis. The Maldives is struggling with a huge amount of debt, and one of the key reasons for this is the loans it took from China.

In this article explaining, how China’s lending has added to the Maldives’ economic problems and what it could mean for the future.

China’s Belt and Road Initiative (BRI) and the Maldives

China launched the Belt and Road Initiative (BRI) to build infrastructure like roads, bridges, and ports in different countries. The Maldives joined this project in 2014, hoping to improve its infrastructure and economy with China’s help.

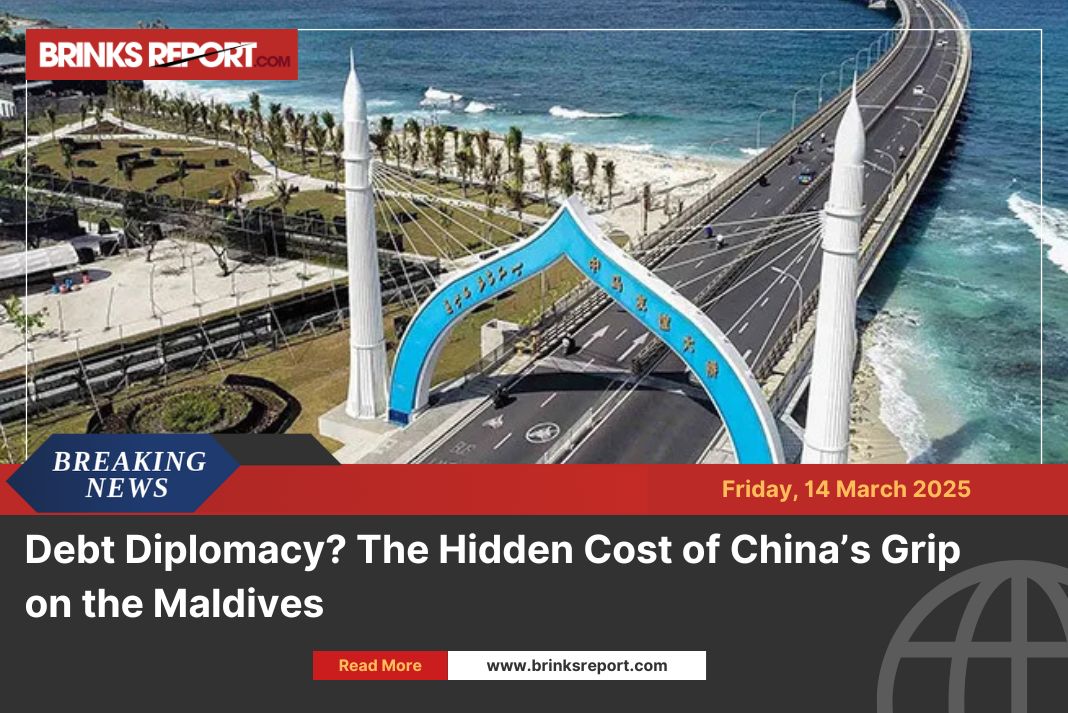

One of the biggest projects under the BRI in the Maldives is the China-Maldives Friendship Bridge. This 1.39-mile bridge, completed in 2018, connects the capital, Malé, to Hulhulé Island. The bridge was meant to improve transportation and boost the economy. However, the costs went much higher than expected, adding to the Maldives’ financial burden.

Read More: China Urges Banks to Boost Loans for Consumer Spending

Debt Crisis: Is the Maldives Trapped?

The Maldives has borrowed a large amount of money from China. Reports suggest the country owes around $1.4 billion to China. This is a massive debt for a small country with a GDP of only $5.6 billion. The high interest rates on these loans have made it difficult for the Maldives to repay them, raising fears of a “debt trap.”

Some experts believe China’s lending practices force small countries into economic trouble. When countries struggle to repay, China can gain control over important infrastructure. This is known as “debt trap diplomacy.”

In the Maldives, the debt to China is more than 20% of its GDP, making many worry that the country might lose control over its key assets if it fails to pay.

Other Economic Problems Facing the Maldives

Although China’s loans have contributed to the crisis, they are not the only reason for the Maldives’ financial struggles. The country’s economy depends mainly on tourism and fishing, making it vulnerable to global events.

The COVID-19 pandemic hit the Maldives hard, as travel restrictions led to a drop in tourism. In 2020, the Maldives’ economy shrank by nearly 29%, one of the worst declines in the region.

Additionally, the Maldives faces other challenges, such as climate change and political instability. Rising sea levels threaten the country, and frequent political conflicts have discouraged foreign investors.

Despite these challenges, the huge debt from China has made it harder for the Maldives to handle its financial troubles. The government now has very little flexibility to invest in other important areas.

Also Read: China Digs In: Ready to Battle U.S. Tariffs ‘Till the End’ as Trade War Escalates

Will the Maldives Go Bankrupt?

The Maldives is at serious risk of bankruptcy if it does not get debt relief or increase its income significantly. In 2023, the country already missed a $150 million bond payment, raising concerns among investors.

If the Maldives defaults on its debt, the impact will not be limited to just one country. Other nations with BRI loans, such as Sri Lanka and Pakistan, are also struggling with debt. Many countries will be closely watching how China responds to the Maldives’ crisis.

For China, this situation is tricky. If the Maldives defaults, it could damage China’s reputation as a trustworthy financial partner. But if China helps by reducing or restructuring the debt, it might improve its global image and strengthen relationships with small island nations.

Key Lessons from the Maldives’ Crisis

The Maldives’ financial struggles are a warning for other developing nations about the risks of taking large loans without proper planning.

While infrastructure development is important, borrowing money without a clear plan for repayment can lead to serious financial problems.

To recover, the Maldivian government must work with international partners, including China, to secure debt relief and create policies for a stable economy. Other countries thinking about joining China’s BRI projects should carefully assess whether the loans are sustainable in the long run.

The Maldives’ situation is a lesson for the world: economic growth must go hand in hand with responsible financial planning. As the country faces an uncertain future, the world is watching to see how it manages to recover from this crisis.