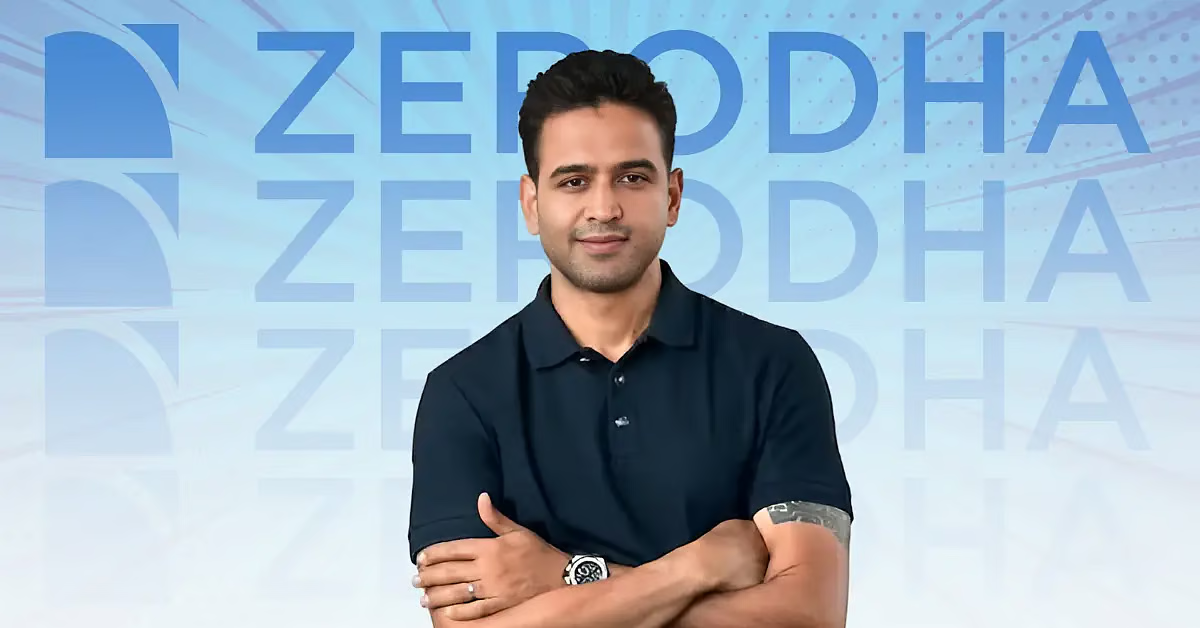

The Indian stock market has been rattled by a steep correction over recent weeks, leaving investors anxious. Nithin Kamath on share market crash concerns has now sounded a stark warning: prolonged volatility could force the government to intervene. The Zerodha CEO, whose platform serves millions of retail traders, highlighted a startling trend—a 40% drop in retail investor participation since the downturn began.

The Big Drop: Retail Investors Exit Amid Panic

Kamath pointed out that retail investors, who flooded the market during the 2021–2023 bull run, are now retreating rapidly. “New demat account openings have plummeted by nearly half,” he noted. This exodus threatens market liquidity, a critical factor for stability. If retail activity continues to decline, Nithin Kamath on share market crash fears it could trigger a domino effect, spooking institutional players and deepening losses.

Why Did the Market Crash Happen?

Several factors fueled the correction:

- Global Economic Uncertainty: Rising U.S. interest rates and geopolitical tensions.

- Overvaluation Concerns: Indian indices hit all-time highs in 2023, raising fears of a bubble.

- Domestic Inflation Pressures: RBI’s rate hikes dented investor confidence.

Kamath emphasized that retail investors, many of whom are first-time traders, are especially vulnerable. “Newcomers often misinterpret volatility as a ‘discount opportunity,’ not realizing the risks,” he said.

The markets are finally correcting. Given that markets swing between extremes, they can fall more just like they rose to the peak.

I’ve no idea where the markets go from here, but I can tell you about the broking industry. We are seeing a massive drop in terms of both the number… pic.twitter.com/wHO6hSRdbA

— Nithin Kamath (@Nithin0dha) February 28, 2025

Will the Government Intervene?

Nithin Kamath on share market crash scenarios warned that sustained turmoil could prompt policymakers to act. Potential measures include:

- Regulatory Tweaks: Easier margin norms or relaxed trading restrictions.

- Fiscal Stimulus: Sector-specific incentives to boost sentiment.

- PSU Divestment Halts: Delaying large-scale sell-offs to avoid oversupply.

Kamath stressed that intervention should be a last resort. “Markets thrive on organic demand, not bailouts,” he argued.

Read More : ICICI Bank Shares Surge on Record Q3 Profits Strong Earnings Boost Market Confidence

What Should Investors Do Now?

The Zerodha CEO advised caution:

- Avoid panic selling: Volatility is part of equity investing.

- Diversify: Spread investments across asset classes like bonds or gold.

- Educate Yourself: Understand market cycles before trading.

Read More : Chandrayaan-3’s Shiv Shakti Point: Uncovering 3.7 Billion-Year-Old Lunar Secrets

The Road Ahead: A Test of Resilience

While corrections are painful, Kamath believes they “reset unrealistic expectations.” For now, all eyes are on retail activity—the canary in the coal mine. If the share market crash persists, the ball may land in the government’s court. But as Kamath reminded investors, “Long-term wealth is built by staying calm, not chasing shortcuts.”